Tax Implications of Home Renovation: What You Can and Can’t Deduct

DECEMBER 01, 2025

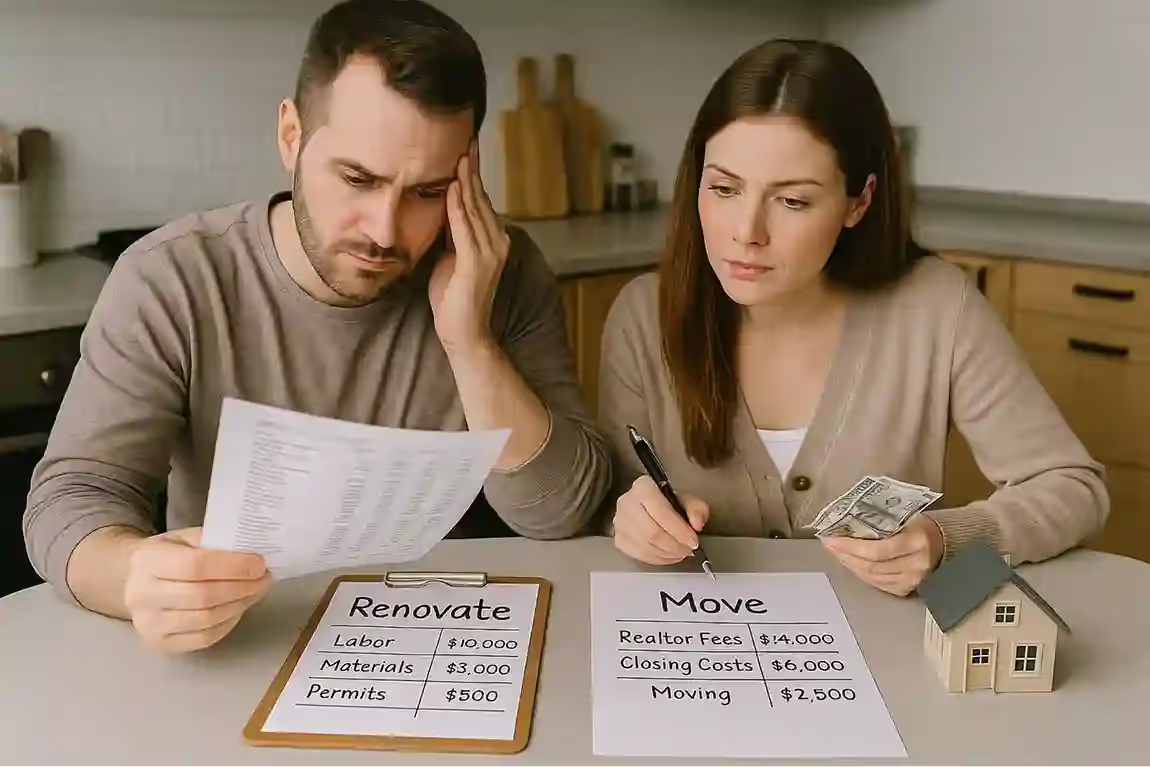

A growing family stands in their cramped 1970s kitchen, contemplating a $65,000 renovation that would create the open-concept space they dream about. But for $75,000, they could move into a larger, already-renovated home just two neighborhoods away. The renovation promises to keep them in their beloved community near friends and schools, while moving offers instant gratification without construction chaos. Yet neither option's price tag tells the real story. Behind the renovation bid lurk hidden costs: temporary housing during construction, architect fees, permit delays, and the 20% contingency for surprises behind the walls. Behind the move hides agent commissions, closing costs, moving expenses, higher property taxes, and the emotional toll of uprooting established routines. This decision isn't about comparing two numbers—it's about evaluating two complex webs of visible and invisible costs that will impact finances, relationships, and quality of life for years to come. Most families make this choice emotionally rather than systematically, leading to regret that persists long after the dust settles.

The renovate-versus-move decision represents one of the most significant financial and lifestyle choices homeowners face, yet most approach it with surprising informality. They tally the obvious costs—renovation bids versus home prices—and make gut-based decisions that ignore critical hidden expenses, long-term implications, and psychological factors that ultimately determine satisfaction. According to the Joint Center for Housing Studies at Harvard University, Americans spent over $600 billion on home renovations in 2024 alone, a figure that has increased by roughly 50% compared to pre-pandemic levels. This framework provides a systematic methodology for evaluating both options through a comprehensive lens that captures what spreadsheets miss: the true cost of disruption, the value of emotional attachment, the risk of renovation surprises, and the hidden financial drains of relocation.

The stakes are substantial. A poorly planned renovation can turn into a financial nightmare that exceeds moving costs while leaving you with a compromised result you must live with daily. A hasty move can land you in a new home that solves some problems but creates others, while draining equity through transaction costs that approach 10-15% of your home's value. The decision requires more than simple math—it demands a holistic evaluation of your family's priorities, timeline, risk tolerance, and long-term goals. By examining the hidden cost structures underlying both options, you can make an informed choice that serves both your immediate needs and future financial health.

Renovation costs extend far beyond contractor bids and material selections, creating a financial burden that often surprises even experienced homeowners. The visible tip of the iceberg includes demolition, construction labor, finishes, and fixtures—the line items that appear in every quote. But beneath the waterline lurk dozens of hidden expenses that can inflate your budget by 30-50% above initial estimates. Permit fees, which vary wildly by municipality, often run $500-$2,000 and require multiple inspections that can delay projects. Architectural or design fees for projects involving structural changes typically cost 5-10% of construction costs. Temporary housing during major renovations frequently becomes necessary when kitchens or bathrooms become unusable, adding $2,000-$5,000 for extended hotel stays or short-term rentals. According to Houzz research data, the median spend on home renovations totaled $24,000 in recent years, representing a 60% increase from 2020, with top-tier homeowners spending a median of $150,000 or more on their projects.

The contingency fund—recommended at 20% of your base budget for unforeseen issues—represents the largest hidden renovation cost but also the most critical. When contractors open walls to discover outdated wiring that can't support modern appliances, or find water damage behind shower tiles, these mandatory fixes must be addressed before cosmetic work can proceed. Without contingency funds, homeowners face the terrible triad of options: halt the project mid-stream, finance emergency repairs at high interest rates, or accept dangerous shortcuts that compromise safety and code compliance. The psychological burden of mid-project financial crisis often exceeds the monetary cost, creating stress that damages relationships and work performance. Research from the National Association of Realtors Remodeling Impact Report indicates that 39% of homeowners went over their renovation project budget, while 24% didn't set a budget at all—a recipe for financial disaster that underscores the importance of rigorous planning and realistic contingency reserves.

Moving costs, while seemingly straightforward, conceal their own iceberg of hidden expenses. Real estate agent commissions typically consume 5-6% of your home's sale price—$15,000-$18,000 on a $300,000 property. According to Bankrate's analysis of closing costs, closing costs for both selling and buying add another 2-4% of each transaction value, with average buyer closing costs reaching approximately $4,661 excluding real estate agent commissions, and these figures varying dramatically by state—Washington D.C. homebuyers pay the highest average closing costs at $17,545, while Missouri residents pay the lowest at $1,740. Pre-sale home preparation, including staging, repairs identified during inspection, and cosmetic touch-ups, often requires $2,000-$5,000. The physical move itself costs $1,000-$5,000 depending on distance and belongings. But these are just the visible costs that appear on invoices and settlement statements.

The submerged moving costs include higher property taxes on your new, more expensive home, which can add hundreds of dollars monthly for as long as you own it. Utility connection fees, new furniture for different spaces, window treatments for unfamiliar window sizes, and the inevitable "while we're moving" upgrades accumulate rapidly. Time off work for house hunting, packing, and closing appointments represents lost income that rarely gets factored into calculations. The emotional cost of leaving established neighborhoods, schools, and routines—the community capital you've built over years—carries no price tag but tremendous value that many movers regret losing only after it's too late. Studies from the National Institutes of Health research on housing and mental health demonstrate that homeownership and housing stability are associated with significant reductions in psychological distress, highlighting the mental health implications of major housing transitions.

To accurately compare renovation versus moving, you must calculate the five-year true cost, which captures immediate expenses plus ongoing financial implications that differ between options. Start with renovation costs: take your contractor's bid and add 15-20% contingency, 5% for design and permits, 5% for temporary living expenses, and 3% for furnishings that complement the new space. For a $100,000 base bid, this means budgeting $128,000-$133,000 total. Now calculate your monthly cost: if you're financing through a home equity loan at 7% over 15 years, that's approximately $1,150-$1,200 monthly. Over five years, you'll pay $69,000-$72,000 in payments, of which about $18,000 is principal, leaving $51,000-$54,000 in interest costs. Total five-year renovation expense: $179,000-$205,000, depending on your contingency needs and whether unforeseen issues arise during the project. Understanding your financing options is critical—the Consumer Financial Protection Bureau's guide to home equity lines of credit provides essential information for homeowners considering tapping their equity to fund renovations.

The moving calculation begins with your current home's sale price minus transaction costs. On a $300,000 sale, subtract 6% commission ($18,000) and 2% closing costs ($6,000), netting $276,000. If your mortgage balance is $200,000, you walk away with $76,000 equity minus $3,000 in moving expenses and $2,000 in pre-sale repairs, leaving $71,000. This becomes your down payment on a $400,000 new home, requiring a $329,000 mortgage at current rates (approximately 7% for 30 years), costing $2,190 monthly—likely $500-$1,000 more than your current payment. Over five years, you'll pay $131,400, with roughly $15,000 going to principal and $116,400 to interest. Add property tax increases (let's say $2,400 annually) and you've spent $12,000 more in taxes. Total five-year moving expense: $131,400 (interest) + $12,000 (taxes) + $23,000 (sale costs) + $5,000 (move prep) = $171,400. The Zillow housing data research center provides comprehensive metrics for understanding local market conditions, including home value trends, inventory levels, and days on market—all factors that influence whether moving makes financial sense in your specific situation.

The interest rate environment significantly impacts this calculation. If you have a 3.5% mortgage on your current home, moving to a 7% rate creates a far larger cost gap than just the principal increase. In our example, keeping the current $200,000 mortgage at 3.5% costs $898 monthly versus $2,190 for the new $329,000 mortgage at 7%—a $1,292 monthly difference that adds $77,520 over five years in interest alone. This often makes staying and renovating dramatically more cost-effective, even if renovation bids seem high. Current homeowners with mortgages below 4% face a massive moving penalty. That low rate is an asset worth tens of thousands of dollars in avoided interest costs. Moving means forfeiting this asset forever, paying exponentially more interest on a larger loan at higher rates. Calculate your "mortgage asset value"—the interest savings your current rate provides versus market rates. This often exceeds $50,000 in avoided costs, making it a powerful factor in the renovate-vs-move decision that emotional reasoning completely ignores.

Some problems renovation cannot solve, making moving the only logical choice regardless of cost comparisons. Insufficient land or lot size constraints top this list. If your family has outgrown both your home's interior and outdoor space, no amount of remodeling creates a larger yard or adds the missing acreage you need for gardens, play areas, or privacy. Similarly, if zoning restrictions prevent additions or limit your ability to expand, renovation becomes a frustrating exercise in compromise rather than a genuine solution. The location limitations framework helps identify deal-breaker issues that override financial calculations. Before investing thousands in renovation planning, consult with local building departments about setback requirements, height restrictions, and lot coverage maximums that could render your expansion dreams impossible. A professional home inspection from an American Society of Home Inspectors (ASHI) certified inspector can reveal structural limitations that affect renovation feasibility before you've invested in architectural drawings.

Lifestyle mismatch creates another non-negotiable scenario. If your commute has become unbearable and no job change is imminent, living in a renovated house you'll resent because of daily travel stress negates any enjoyment of the improvements. Similarly, if your neighborhood's character has changed dramatically—safety concerns, incompatible neighbors, shifting demographics—no amount of kitchen remodeling addresses the fundamental discomfort of your location. Renovation improves your home, not your surroundings. School district quality represents another location-bound factor that renovation cannot address. If your children need better educational options and you're zoned for underperforming schools, moving may be the only path forward regardless of how much you love your current home's bones. The Fannie Mae closing costs calculator can help you understand the true financial impact of a potential move, allowing you to weigh relocation costs against the intangible benefits of a better location.

Structural limitations sometimes make renovation impractical regardless of budget. Homes with load-bearing walls in awkward configurations, ceiling heights too low to raise, or foundations too compromised for second-story additions may require such extensive (and expensive) structural work that moving becomes cheaper and wiser. A professional structural engineer's assessment during early planning stages can reveal these limitations before you've invested thousands in design work and permits. Foundation issues, in particular, can transform a modest renovation into a six-figure nightmare when contractors discover settling, cracking, or water infiltration that must be addressed before any cosmetic work can proceed. Conversely, renovation shines when your location is ideal but your home's interior doesn't match your lifestyle. If you love your neighbors, your children's schools are excellent, your commute is reasonable, and your lot suits your needs, staying put typically outweighs moving's advantages even when renovation costs seem high. The community capital you've built—relationships, routines, local knowledge—has tangible value that moving costs don't capture but that significantly impacts daily happiness and family stability.

The psychological return on investment often outweighs financial considerations, yet homeowners rarely quantify this factor systematically. Renovation stress is real and measurable—construction dust invading living spaces, decision fatigue from thousands of choices, delays that extend disruption for months, and relationship strain when partners disagree on design or budget priorities. Research shows that major renovations increase stress hormones and decrease marital satisfaction during the project period, with recovery taking 6-12 months post-completion. According to studies cited in environmental psychology research, the built environment has significant effects on mental health, with housing conditions influencing everything from stress levels to depressive symptoms. Nearly 70% of homeowners experience significant stress during renovation projects according to industry surveys, impacting their daily lives and overall well-being in ways that extend far beyond the construction timeline. However, successful renovations also create deep satisfaction from customization, pride of ownership, and the daily enjoyment of spaces tailored precisely to your preferences—psychological benefits that accumulate over years of living in a home that truly fits your needs.

Moving stress manifests differently—grief from leaving familiar surroundings, anxiety about new neighborhoods and schools, the overwhelming logistics of packing and resettling, and loneliness while rebuilding social connections. The emotional toll of relocation often peaks 3-6 months after moving, when the excitement of a new home fades but new routines and friendships haven't fully formed. Children may struggle with school transitions, requiring additional parental attention during an already demanding period. Elderly family members may find relocation particularly disorienting, losing the environmental cues that support daily functioning. However, moving also offers fresh starts, new opportunities, and the thrill of discovering a new community that some personalities find energizing rather than draining. For families escaping toxic neighbor situations, declining neighborhoods, or homes with painful memories, moving provides psychological relief that renovation cannot deliver. The key is honest self-assessment about which type of stress your family is better equipped to handle given current life circumstances, existing support systems, and individual temperaments.

To quantify emotional impact, create a stress budget that assigns monetary value to psychological costs. Rate your anticipated stress level for each option on a 1-10 scale, then multiply by your household's monthly income to estimate productivity loss and increased spending on stress relief (takeout, therapy, entertainment). A renovation rated 8/10 stress for a household earning $8,000 monthly creates $64,000 in psychological costs over the typical 8-month renovation period. A move rated 6/10 stress for 4 months creates $19,200 in emotional costs. While these figures are conceptual rather than literal, they force recognition that emotional factors have real financial implications through reduced earnings, increased healthcare utilization, and compensatory spending. The Remodeling Futures Program at Harvard tracks broader remodeling market trends that can help you understand whether current conditions favor renovation projects or whether market factors might add additional stress to your project timeline.

Market conditions can make moving financially advantageous or impossible regardless of other factors. In a seller's market where inventory is low and prices are rising, your current home may command premium prices that offset transaction costs, while finding an affordable replacement property becomes challenging. Conversely, in a buyer's market with abundant inventory, moving offers the chance to purchase your ideal home at a discount, making it a strategic financial move despite transaction costs. Understanding where your local market stands on this spectrum is essential before making any decision. The Zillow Home Value Index provides real-time data on typical home values and market changes across different regions, helping you assess whether current conditions favor buyers or sellers in your specific area. As of late 2024, the average U.S. home value stands at approximately $369,147, with homes typically going to pending status in around 17 days—metrics that vary dramatically by location and price tier.

Interest rate environments dramatically impact the calculation. Homeowners with mortgages below 4% possess a valuable asset that moving forfeits. The difference between a 3.5% rate on a $200,000 mortgage ($898 monthly) and a 7% rate on a $350,000 mortgage ($2,328 monthly) adds $1,430 monthly or $85,800 over five years—often more than the renovation cost you're trying to avoid. Even if you can afford the higher payment, the interest premium represents pure financial loss that could have funded extensive renovations. For homeowners who purchased or refinanced during the 2020-2021 period of historically low rates, this "golden handcuffs" phenomenon creates a powerful incentive to renovate rather than move, fundamentally altering the traditional cost comparison that assumed relatively stable interest rate environments between buying and selling transactions.

Construction market conditions affect renovation viability. During periods of high contractor demand and material cost inflation, renovation bids may exceed reasonable value, making moving comparatively attractive. During slower construction periods, competitive bidding and material availability can reduce renovation costs by 20-30%, strengthening the case for staying. The Leading Indicator of Remodeling Activity (LIRA) published by Harvard's Joint Center for Housing Studies projects remodeling spending trends and can help you understand whether the construction market favors homeowners or contractors. Recent data suggests that year-over-year spending for home renovation and repair is expected to increase by 2.5%, reaching a record $526 billion by early 2026. Additionally, if your area experiences rapidly increasing property values, renovating leverages your existing low-tax-basis property while its value appreciates, whereas moving resets your tax basis higher and forgoes future appreciation on a larger, more leveraged asset. This tax basis consideration becomes increasingly important in states with property tax limitations that grandfather existing homeowners at lower assessed values.

Understanding your financing options is crucial for making an informed renovation decision. Home equity lines of credit (HELOCs) offer flexibility, allowing you to borrow against your home's equity as needed rather than taking a lump sum. However, HELOCs typically carry variable interest rates that can increase over time, potentially straining your budget if rates rise significantly during your project. Home equity loans provide fixed rates and predictable payments but require you to borrow the full amount upfront, potentially resulting in interest charges on funds you don't immediately need. Cash-out refinancing replaces your existing mortgage with a larger one, providing renovation funds but resetting your rate—a potentially costly proposition if you currently have a below-market mortgage. For homeowners who purchased or refinanced during the 2020-2021 low-rate period, maintaining the existing mortgage while using a separate home equity product often proves more economical despite the additional complexity.

For more extensive renovations, the FHA 203(k) Rehabilitation Mortgage Insurance Program offers a unique option that combines home purchase or refinance with renovation costs in a single loan. The program comes in two versions: the Standard 203(k) for major rehabilitations requiring structural work, and the Limited 203(k) for minor remodeling with repair costs up to $75,000. These government-backed loans offer several advantages, including lower down payment requirements than conventional renovation loans and the ability to finance both purchase and renovation costs together. However, they also come with additional requirements including the use of HUD-approved consultants for larger projects and specific timelines for completing renovation work. Recent updates to the program have increased allowable rehabilitation periods and consultant fee schedules, making the program more practical for homeowners undertaking significant renovation projects.

Personal loans and credit cards should generally be avoided for renovation financing due to their higher interest rates, though they may serve as bridge financing for small, urgent repairs. Some contractors offer financing through partnerships with lending institutions, often featuring promotional rates for qualified buyers. However, carefully review the terms of any contractor-arranged financing, as promotional periods may be shorter than your project timeline, and default rates after promotional periods can exceed credit card rates. Credit unions often offer more favorable terms than traditional banks for home improvement loans, making them worth investigating before committing to any financing arrangement. Regardless of which financing method you choose, factor the total cost of borrowing—including all interest charges over the repayment period—into your renovation versus moving comparison to ensure an apples-to-apples evaluation.

The Johnson family loved their 1,800-square-foot home in a top-rated school district with a 15-minute commute. When their third child arrived, they needed more space but couldn't find larger homes in their price range within the same district. They considered moving to a nearby suburb with lesser schools for $50,000 more, plus $30,000 in transaction costs. Instead, they invested $85,000 in a second-story addition, staying in their preferred location. The renovation exceeded their $60,000 base budget due to structural surprises, but the $25,000 contingency covered it without stress. Seven years later, the addition added $90,000 in value while their children attended excellent schools. Renovation wins when location is paramount and budget includes adequate contingency. The Johnsons also benefited from their 3.2% mortgage rate, which they would have forfeited by moving—a factor worth an additional $40,000 in avoided interest costs over their remaining loan term. Their experience illustrates how the combination of location value, favorable existing financing, and adequate contingency planning can make renovation the clear choice despite higher upfront costs than anticipated.

The Martinez family faced a different scenario. Their 40-year-old home needed $120,000 in updates: new roof, HVAC, kitchen, and bathroom renovations. Their neighborhood had declined with increasing crime and poor schools. A similar home in a better school district cost $50,000 more, with $35,000 in transaction costs—$85,000 total. Despite loving their community, the declining environment and the fact that renovation wouldn't fix location issues made moving the clear choice. They sold quickly (a rarity in their area), avoided sinking $120,000 into a depreciating asset, and their children thrived in the new school district. Moving wins when location problems outweigh home problems. The Martinez family's situation also highlights an important principle: renovation should build equity in an appreciating asset, not throw good money after bad in a declining market. Their decision to cut losses early, rather than hoping for neighborhood improvement that never materialized, preserved their financial flexibility and improved their family's quality of life in ways that renovation could never have accomplished.

The Chen family illustrates the interest rate trap. They had a $250,000 mortgage at 3.25% and considered a $100,000 renovation. New homes meeting their needs cost $450,000, requiring a $350,000 mortgage at 7.25%. Their monthly payment would jump from $1,088 to $2,387—$1,299 more. Over five years, that's $77,940 in additional interest costs alone, plus $40,000 in transaction fees. The $100,000 renovation, even with a $20,000 contingency, cost $120,000 financed at 5% home equity rate, adding $637 monthly but building equity in their current low-rate loan. The math made renovation the obvious choice, saving them approximately $60,000 over five years while preserving their affordable monthly payment. The Chens also appreciated that their renovated home would be customized exactly to their preferences, rather than compromising on a move-in ready property that met most but not all of their needs—a psychological benefit that doesn't appear in spreadsheets but contributes significantly to long-term satisfaction.

The Thompson family's story shows when renovation fails. They budgeted $80,000 for a kitchen and master suite renovation in their 1970s ranch. When demolition revealed outdated electrical that couldn't support modern demands, they spent $8,000 upgrading the panel. Then they discovered load-bearing walls prevented the open concept they wanted, requiring a $12,000 engineered beam. Mold remediation added $5,000. Before they knew it, the $80,000 project became $105,000, and the compromised layout still didn't match their vision. Selling and buying a newer home with the layout they wanted cost $110,000 in transaction costs but gave them exactly what they wanted without the stress of unforeseen problems. They regretted not moving initially and wasting months in renovation chaos. Moving wins when renovation complexity exceeds initial assessment and older homes harbor too many unknowns. The Thompson experience underscores the importance of thorough pre-renovation inspections and realistic assessments of older home conditions before committing to major projects.

Engaging the right professionals early in your decision-making process can prevent costly mistakes and provide clarity on which option best suits your situation. A qualified home inspector can identify structural issues, code violations, and hidden problems that affect renovation feasibility and cost. Look for inspectors certified by the American Society of Home Inspectors who have passed rigorous examinations testing their knowledge of residential construction, defect recognition, and inspection techniques. Pre-renovation inspections differ from standard pre-purchase inspections—they focus specifically on the systems and structures that will be affected by your planned changes, identifying potential complications before you've committed to a design. For renovations involving structural changes, a licensed structural engineer's assessment is essential. While this adds $500-$1,500 to your planning costs, it can prevent the nightmare scenario of discovering mid-project that your dream renovation is physically impossible or prohibitively expensive to achieve safely.

Real estate agents provide market insight essential for the moving side of your analysis. A good buyer's agent can identify properties that meet your needs and help you understand realistic pricing in your target areas. A listing agent can provide a comparative market analysis showing what your current home would likely sell for and how long it might take. However, remember that agents have financial incentives favoring transactions—they earn nothing if you renovate and stay. Seek independent market data from sources like Zillow's housing research to validate agent opinions and ensure you're making decisions based on objective market conditions rather than sales pressure. Fee-only financial advisors can also provide valuable perspective, analyzing how renovation financing or a new mortgage fits into your broader financial picture, including retirement savings, emergency funds, and other financial goals that housing decisions affect.

Architects and designers bring creative solutions that can make renovation more feasible than you initially imagined. An experienced residential architect may see possibilities for achieving your goals within structural constraints that you hadn't considered. Design-build firms offer integrated services that can streamline the renovation process, though you sacrifice the independent oversight that comes from having separate design and construction teams. For complex projects, hiring an owner's representative—an independent professional who manages the project on your behalf—can reduce stress, catch problems early, and ensure contractor accountability. The National Association of the Remodeling Industry (NARI) provides resources for finding qualified contractors and understanding what to expect from professional renovation services. Taking time to assemble the right professional team before committing to either path ensures your decision is based on accurate information rather than assumptions that may prove costly to correct later.

The renovate-versus-move decision ultimately balances four core elements: financial reality, functional necessity, emotional capacity, and market timing. No single factor dominates the others; instead, they create a decision ecosystem where each element influences the whole. The family who chooses renovation based solely on loving their location may face financial strain they could have avoided. The family who moves based purely on financial calculations may discover they've traded fiscal savings for daily misery in a less suitable community. The framework that serves you best begins with honest assessment of non-negotiable factors: Does your location meet core needs? Can your home's structure accommodate required changes? Does your financial capacity include realistic contingency planning? Are you emotionally equipped for renovation disruption or moving stress? Answering these questions truthfully—without the optimism bias that plagues renovation planning or the grass-is-greener distortion that affects moving decisions—creates clarity that emotional reasoning cannot provide.

Create a scoring system that evaluates each factor on a 1-5 scale, weighted by importance to your family's priorities. Financial cost might carry weight of 5, emotional stress weight of 4, location quality weight of 5, and timeline flexibility weight of 3. Rate renovation and moving options for each factor, then multiply by weights to calculate weighted scores. This systematic approach prevents emotional reasoning from dominating the decision. Sample scoring for a hypothetical family: Financial cost (Weight 5): Renovation scores 3 (moderate expense), Moving scores 2 (higher cost)—Renovation weighted score: 15, Moving: 10. Emotional stress (Weight 4): Renovation scores 2 (high stress), Moving scores 3 (moderate stress)—Renovation: 8, Moving: 12. Location quality (Weight 5): Renovation scores 5 (perfect location), Moving scores 3 (good but not ideal)—Renovation: 25, Moving: 15. Timeline (Weight 3): Renovation scores 2 (long timeline), Moving scores 4 (quick)—Renovation: 6, Moving: 12. Total weighted scores: Renovation 54, Moving 49, suggesting renovation is the better-aligned choice for this family's priorities despite higher stress.

The matrix reveals that no single factor should dominate the decision. A family might score renovation higher on financial and location measures but moving higher on stress and timeline, indicating a genuine trade-off rather than a clear winner. When scores are within 10% of each other, the decision becomes preference-driven rather than evidence-driven. When one option scores 20% or more higher, the data points toward a clear choice that you should justify deviating from only for compelling non-quantified reasons. Most importantly, remember that both options represent paths forward, not permanent traps. Renovation can be staged over time to spread costs. Moving doesn't require your "forever home"—you can transition to a satisfactory property and continue evaluating options. The goal isn't perfection but rather intentional choice that aligns with your complete life picture, not just the spreadsheet. By examining hidden costs, emotional impacts, and timing factors alongside obvious expenses, you transform a potentially paralyzing decision into an empowering strategic move that serves your family's true priorities and positions you for long-term satisfaction regardless of which path you choose.

DECEMBER 01, 2025

DECEMBER 01, 2025

DECEMBER 01, 2025

DECEMBER 01, 2025

NOVEMBER 28, 2025